Well that title may be a bit subjective. It seems like the world is always battling some kind of crisis which can add a considerable amount of volatility to the returns of the stock market. Trying to find a safer investment with a consistent history of returns can often be difficult, especially when most trading products are correlated with the overall market performance.

THIS IS WHY FGMNX IS THE GREATEST BOND FUND IN THE WORLD (right now)

Here is the Google Finance description of FGMNX - "The investment seeks a high level of current income. The fund normally invests at least 80% of assets in Ginnie Maes and repurchase agreements for Ginnie Maes. It invests in other U.S. government securities and instruments related to U.S. government securities and in U.S. government securities issued by entities that are chartered or sponsored by Congress but whose securities are neither issued nor guaranteed by the U.S. Treasury. The fund allocates assets across different market sectors and maturities and seeks to have similar overall interest rate risk to the Barclays Capital® GNMA Index. " In addition, the FGMNX has a 5 star Morningstar rating over the past 10 years, has an expense ratio of 0.45%, and assets totaling $9.8 billion.

Let's take a peek at the numbers and the past performance. FGMNX has an average annual return of 3.5% over the past 18 years. It helps that is pays a monthly dividend which helps insulate it from very large drawdowns. The max drawdown over the past 18 years was 6.43%. The equity curve is quite linear and the returns are uncorrelated with the market. Below is a chart of the equity curve for FGMNX compared to the equity curve of SPY, a surrogate for the performance of the S&P500. Both curves are dividend adjusted.

The point of this bond fund is not to outperform the S&P500. FGMNX is best utilized as as safe house during bear market drawdowns in the markets. FGMNX also serves as a good investment to act as a savings vehicle. At the time of this post, most savings accounts are returning less than 1% a year. FGMNX has consistently returned higher than this with little risk. I personally invest all of my short-term savings in FGMNX. Below is a chart of the equity curve drawdowns for FGMNX and SPY.

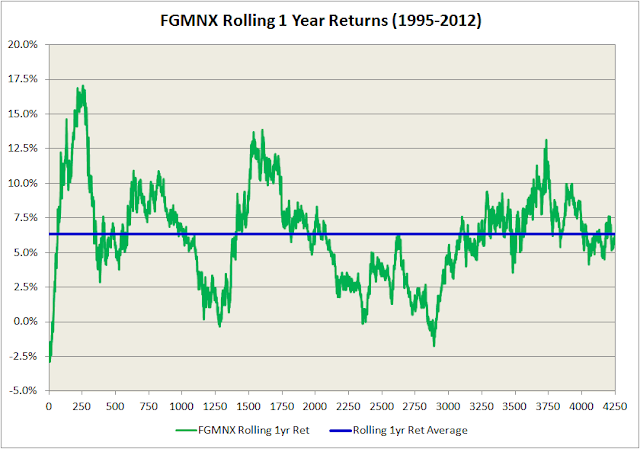

Let's dig a little deeper into the performance to get a better idea of what you can expect from the fund. I like to look at the one year rolling returns to get a sense of what to expect. The average rolling return was 6.3%. What this tells me is that had I chose to invest in FGMNX anytime in the past 18 years and held it for one year, I would have averaged about 6.3% returns on that one year investment. Also, 98% of the 4250 rolling one year returns were above 0%, so the odds are good that you will make money on your investment over the course of one year. Below is a chart that shows the one year rolling returns for FGMNX (green) with the average of all these returns in blue.

In order to understand the risk associated with FGMNX, I like to study the rolling one year max drawdowns. The average rolling max drawdown was -0.5%. This tells me I can expect a drawdown of at least 0.5% when I hold this investment for an entire year. Also, 90% of the rolling one year max drawdowns were -1.5% or better, so that is limited risk. Below is a chart that shows the one year rolling max drawdowns for FGMNX (red) with the average of all these drawdowns in blue.

It is always important to remember that things can change in the future. Regardless, this fund has done an exceptional job of providing consistent returns through some rough times, including the financial crisis of 2008-2009. I will continue to us it for my short-term savings and as a safe-haven during bear markets.

No comments:

Post a Comment