I have been researching ways to filter price data according to trend for my day trading strategy. I have considered using multiple time frame analysis to create a composite filter, but I wanted to start off with something a little more simple.

I really like the appearance of Renko charts. For those who do not know, Renko charts act like a price filter by only plotting a bar when the price action has made a move of a specified number of ticks. For example, if you set the Renko range to 2 ticks, a bar will only print if the price moves up two ticks from the high of the last bar or down two ticks from the low of the last bar. The result is a plot that looks like a series of bricks. This helps to filter out a lot of price noise. If you get sideways action that does not penetrate the range boundaries, no new bar will print. This helps to preserve the underlying trend and seems to be more favorable for trend indicators because of the clean trending action. It also seems to be much easier to identify small retracements in the trend that could be good entry opportunities. I will be looking into this in the future.

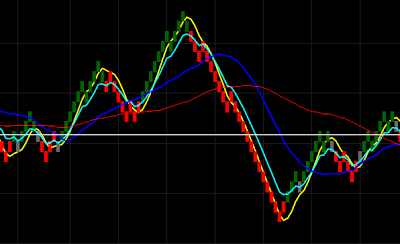

I have experimented with some indicators using Renko charts and the results show some promise. I am thinking of using a higher magnitude Renko chart to determine the trend. Perhaps a setting between 6-10 ticks depending on the recent market volatility. In fact, it would probably be better to automate the adjustment of the brick size based on the recent volatility.

One note, be careful when backtesting with Renko charts. Backtest results can often be inaccurate because much of the price data is not preserved in the data bars. This is especially true on reversals and your results tend to come out more favorable than they would if you were testing with live data. Also, since Renko charts are only concerned with price and not time, be sure to check volume levels carefully. Low volume data will appear to be great trading opportunities because the price can get pushed over large ranges on low volume.

No comments:

Post a Comment