Once again I am using the Vanguard Total Market Index (VTI) component stocks as a proxy for the entire market, which contains 2405 stocks. The backtest analysis will span the time frame beginning on September 15, 1998 to September 15, 2009.

A began the volume analysis by looking at the performance of breakouts when the volume on the breakout day was greater than or equal to the volume on the day before (breakout day showed an increase in volume). This was a preliminary analysis to determine if volume could potentially play a significant role. The results of the analysis are shown below:

The volume hypothesis shows great promise. The volume increase average return per trade was as good or better than the baseline results for all breakout groups, averaging an increase of 0.10%. These results merited further investigation.

For the next analysis, I created several volume thresholds for each breakout percent group. The volume on the breakout day was greater than a breakout factor (BO) multiplied by the previous day's volume. The BO ranged from >1.0 to >20. I analyzed the volume thresholds for each breakout group. Below are the sample results for the 3-4% breakout group:

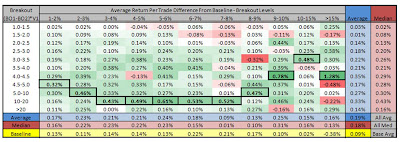

Using the results from each percent group, I compared the difference between the average return per trade for each volume threshold to the average return per trade for the baseline results. I summarized the comparison in the following chart:

The values in the chart are the difference between the volume threshold results and the baseline results for the same percent group. The chart includes the results for each breakout percent group and each volume threshold. I included the average and median values for each grouping, as well as the baseline average return per trade for each percent group.

The first thing that becomes obvious is that the chart is almost entirely green, indicating that the volume threshold average trade returns are greater than the baseline average trade returns. In the lower right corner, the average and median return difference is 0.20% for the volume threshold results. The average baseline return is 0.09% for all breakout percent groups. There is a significant increase in the return for increasing volume. Below is a chart comparing the average and median return per trade difference (right columns from above chart) for each volume threshold:

The first thing that becomes obvious is that the chart is almost entirely green, indicating that the volume threshold average trade returns are greater than the baseline average trade returns. In the lower right corner, the average and median return difference is 0.20% for the volume threshold results. The average baseline return is 0.09% for all breakout percent groups. There is a significant increase in the return for increasing volume. Below is a chart comparing the average and median return per trade difference (right columns from above chart) for each volume threshold:

Once the volume threshold reaches about 2.5V1-3.0V1 the average return difference begins to plateau around 0.23%. The return difference begins dropping off when the volume threshold exceeds 20*V1.

Next I separated the volume thresholds into separate levels to isolate the effect of each volume level without the influence of higher volume levels acting on lower volume levels as seen when using volume thresholds. Below are the sample results for the 3-4% breakout group:

Using the results from each percent group, I compared the difference between the average return per trade for each volume level to the average return per trade for the baseline results. I summarized the comparison in the following chart:

The values in the chart are the difference between the volume level results and the baseline results for the same percent group. The chart includes the results for each breakout percent group and each volume level. I included the average and median values for each grouping, as well as the baseline average return per trade for each percent group. The bold boxes highlight the maximum average return difference for each percent group. All of the maximum returns occur at volume levels between 3.0V1 and 20V1. The 10V1-20V1 volume level contains the largest number of maximum returns that occurs for the 3-8% breakout groups.

For the breakout percent groups below 6-7%, the return differences are mostly positive indicating that the volume level returns are mostly greater than the baseline returns. At breakout percent groups larger than 6-7%, the results are more erratic and scattered in terms of better and worse returns compared to the baseline.

The chart below shows the average return per trade for all breakout percent groups and volume levels:

The values in the chart are colored green if the average return per trade is above 0% and red if the average return per trade is below 0%. The average and median values for each row (volume level) are located in the two columns on the right side of the chart. The average and median values for each column (percent group) are located in the bottom rows. The baseline values are located in the bottom row. The maximum average return per trade for each percent group is indicated by a thick border. All of the average returns greater than or equal to 0.40% are colored in blue font.

The average of all the returns is 0.28% and the median is 0.29%, which are significantly above the baseline average of 0.09%. The average of all the maximum average returns is 0.67%. It is clear that breakouts greater than 15% still exhibit short term mean reversion behavior because the average return for that breakout level is -0.22%. Below is a chart comparing the average return per trade by breakout percent level(two bottom columns from above chart):

The chart shows that increasing volume substantially increases the average return per trade for all breakout percent levels. You can also see that all levels, with the exception of the >15% level, have a positive average return. Additionally, the average return between 0.30%-0.40% is similar across most of the breakout levels. The 7-9% range does have slightly lower average returns, 0.25%-0.30%, but this may be due to the selection of the component stocks as a proxy for the entire market.

Below is a chart comparing the average return per trade by volume level (two right columns from above chart):

The chart shows that the average return per trade steadily increases as the volume breakout factor increases from 1.0V1 to 3.0V1. At 3.0V1, the returns plateau around 0.40% until the 10V1 volume level. The 10V1-20V1 volume level shows the best average return when looking at the median (0.56%). At volume levels greater than 20V1, the average return decreases to around 0.25%.

Out of 121 tests for increasing volume, 39 had an average return per trade greater than 0.40%. Out of those 39 tests with returns greater than 0.40%, 35 occurred for volume levels between 3.0V1 and 20V1 and 32 occurred for percent groups between 3-10%. I ran a backtest for each breakout level and limited the results to volume levels between 3.0V1 and 20V1. I also ran some additional breakout percent levels to test the robustness of the results. Below is a chart summarzing the results of the backtest

The chart above shows that the average return per trade exceeds 0.30% for breakout percent levels between 1-10%, with a maximum average return of 0.50% for the 6-7% level. This is substantially better than the baseline results which had a maximum average return per trade of 0.22%. The results appear to be robust across the various breakout percent levels with average returns ranging from 0.42%-0.45% (win% 54-57%) compared to the baseline average returns of 0.17%-0.20% (win% 52%-53%). The chart below compares the results to the baseline results:

ANALYSIS SUMMARY:

- Breakouts on volume larger than the previous day's volume increase average returns per trade across all breakout levels

- A volume multiplier between 3V1 and 20V1 seems to create the best results overall with an average return per trade of 0.45% for breakout levels between 3-10%

- Volume levels between 10V1-20V1 had some of the largest average returns, especially for breakout percent levels between 3-8% where the average return per trade was 0.68%

- Breakout levels >15% still experience short term mean reversion regardless of volume activity

No comments:

Post a Comment